In 2014-15, the total cost of Calderdale Royal Hospital Private Finance Initiative (PFI) was £23.570m.

This “unitary charge” was made up of:

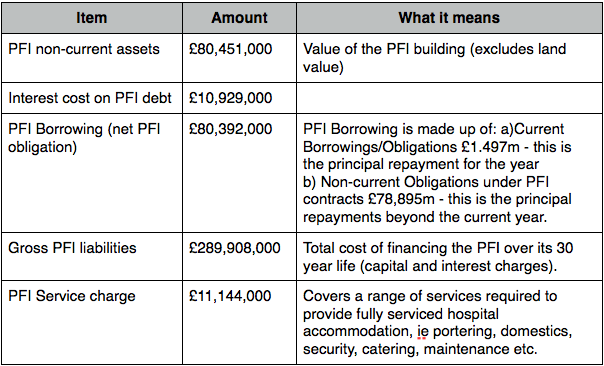

Interest on the debt……… £10.929m

Repayment of the debt…..£ 1.497m

Service charge…………….£11.144m

The value of the hospital building is £80.451m.

The total cost (capital and interest) of the PFI debt over its 30 year life is £289,908,000. This leaves out the high service charges, which cover services like portering, domestics, security, catering, maintenance etc

The PFI charges are set at a level that allows the private investors to get the annual rate of return that they want. The rate of return on PFI investments is way higher than on other types of investments that carry similar risks.

The investors can also increase their returns/profits by selling on their equity to other investors. As long as the new investor is willing to accept a lower rate of return than the seller expected, this represents a capital gain. Investors have attained returns of 40% after selling their equity.

The fact that the sale of equity in Calderdale Royal Hospital PFI has happened 10 times shows how high the initial rate of return must have been, for 9 subsequent buyers to have accepted successively lower rates of return. This means contract prices have been set ridiculously high.

The Calderdale Royal Hospital PFI contract is for 60 years with a break clause at 30 years. Early termination fees would be due at that point in time if the contract was broken then.

The break clause could be exercised in 2031 but according to CHFT, before this decision were made extensive detailed planning would be required to understand the implications both in service and financial terms.

Although the contract is for 60 years, the repayment period for the PFI finance (capital and interest) is 30 years.

The PFI contractor is Calderdale Hospital SPC Ltd (formerly known as Catalyst Healthcare Ltd). For info about how the Calderdale Royal Hospital PFI debt has been sold on and on and on, creating vast profits for bankers, see here.

What would it have cost to build the hospital if public finance had been used?

We need to figure this out, in order to work out what the fair value of the PFI debt is, and then push for its renegotiation to fair value.

The Ministry of Defence routinely reopens contracts when they don’t deliver value for money. The Department of Health should re-open the PFI contracts.

Professor of Public Health, Allyson Pollock, has been calling for this for years. In 2011 she wrote

“Current NHS PFI contracts are not good value and are endangering patient care.”

Work by Jim and Margaret Cuthbert on the Edinburgh New Royal Infirmary PFI scheme, using information from their Freedom of Information requests, found that if the project had been funded by the public sector borrowing from the National Loan Fund, the hospital could have borrowed 2.04 times the amount of capital which was actually raised for the New Royal Infirmary Edinburgh.

One hospital was built for the price of two! This means that the PFI provider is making excessive profits from the PFI scheme.

The Cuthberts’ analysis shows that if adequate central monitoring of PFI schemes had been in place, then it would have been apparent early on that things were going wrong. What was the Department of Health thinking of?

This Great PFI Info graphic shows the costs of the national PFI hospitals under PFI and what the costs might have been using other sources of finance

The CHFT Accounts for 2014-15 show the following information about the PFI debt for the year.

Remind me….who, for the NHS Trust side, entered into the contract? Where are they now?

I don’t know, but it should be fairly easy to find out who in CHFT entered the contract, if not where they are now.

fantastic clear explanation thank you!